This week, a drowsy US economy officially entered its longest expansionary period on record, 121 successive months of growth. Starting with the end of the GFC, the economy has been on a road of recovery ever since. The previous record was the 10 years that followed the 1991 recession.

Much has been made of this achievement, and with good reason. US GDP is now 25 per cent higher in real terms than it was in 2009.

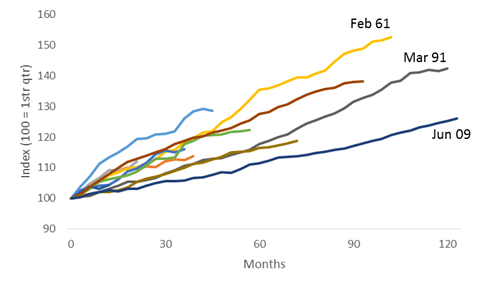

However, while the expansion has been very long, its also been very slow. Growth has averaged just 2.3 per cent. The10 previous expansions (aka the 10 expansions for which data was readily available) averaged growth of 4.7 per cent per year. The previous record holder (1991-2001) sustained growth at 3.6 per cent.

US expansions since 1949, index of real GDP

Source: St Louis FRED for the data, but NBER for the periods. The US does not adopt the same 2 qtr definition we do. These periods are as deemed by the NBER.

The story is even more lacklustre at the per capita level. Per capita incomes are growing in this expansion at 1.5 per cent, less than half the 3.3 per cent of the previous 10.

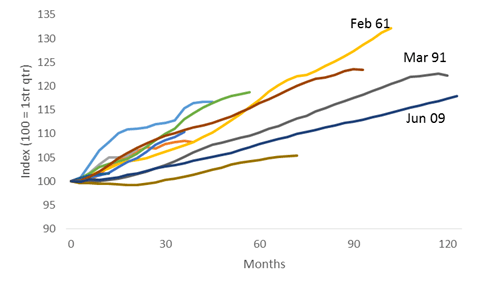

Almost an entire Australia-load of people have found jobs over this period. Indeed, unemployment hasn’t been this low in the US since the moon landings. But while in terms of job creation, this expansion performs a little better, it’s still on the low side (almost half).

US expansions since 1949, index of employment

Source: St Louis FRED for the data, but NBER for the periods. The US does not adopt the same 2 qtr definition we do. These periods are as deemed by the NBER.

Speaking of Australia, Australia’s record run of growth has been going now for something like 333 months. At an average of 3.2 per cent (albeit slowing lately), it makes the US’ current run look a little poultry.

Current Aus and US expansions, index of real GDP

Source: St Louis FRED.

Had the US economy expanded at a more “normal” rate, real GDP would have been 30-50 per cent higher, with an extra 20 million jobs.

That said, slow growth is better than no growth — and that’s where all the conversations seem to be heading. How long can this last?

The economy is facing a few mild headwinds breezes. The tax cuts introduced last year provided the economy with a sugar hit, but that seems to be wearing off. Tensions with China (and Europe and Japan and India) are still a thing, but are perhaps more of an issue for the stock market than the real economy. Hiring rates have starred to slow, wage pressures are starting to bite and firms are increasingly complaining of labour shortages.

Of course, there’s no natural reason why the expansion should end. The most convincing argument that the expansion will continue seems to be: “expansions do not die of old age”, just look at Australia.

Leave a comment